are taxes cheaper in arizona than california

The job market is not the point of consideration. Arizona is one of the lowest in the nation at 374 cents a gallon.

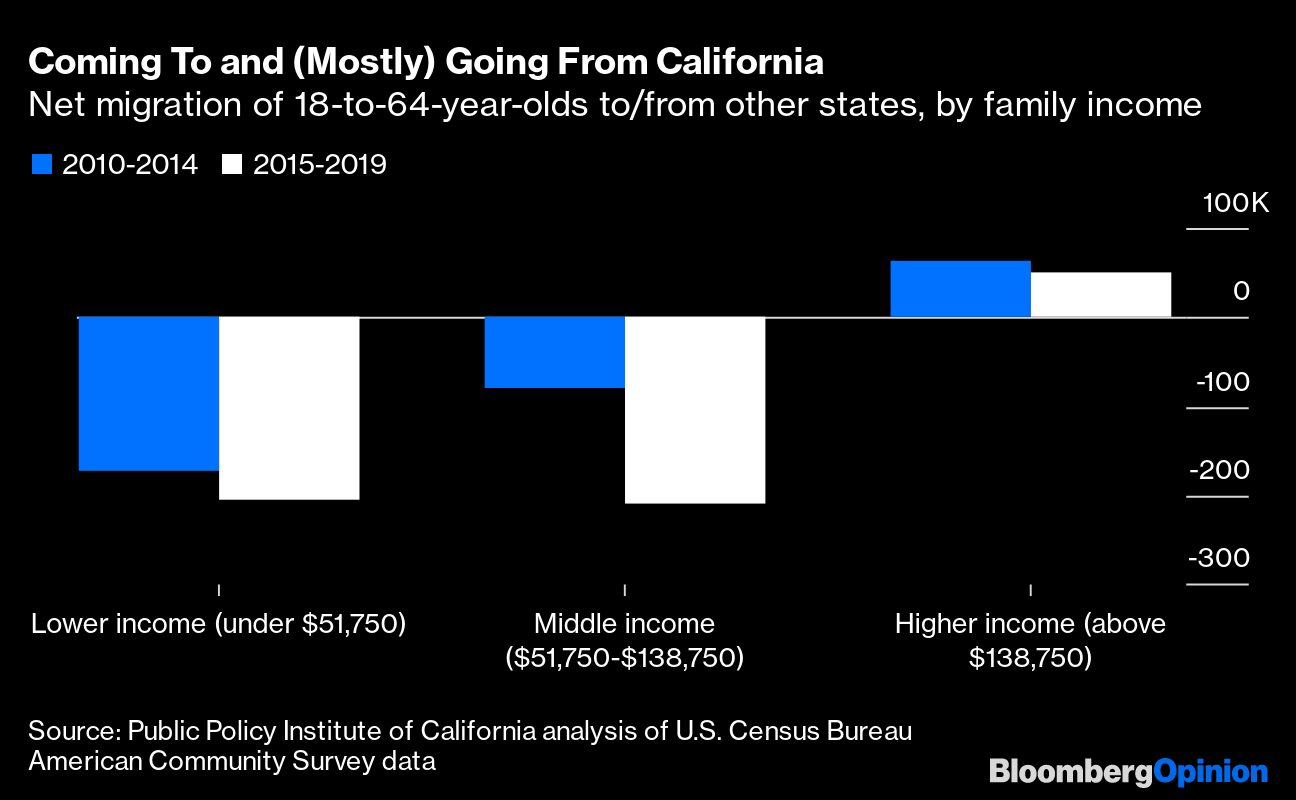

California S Population Exodus Is Intensifying Los Angeles Times

Are taxes higher in Arizona than California.

. Tax Rates in both these states differ greatly. Residents of the coastal state have to pay almost twice more of the state income tax. Are taxes higher in Arizona than California.

California on the other hand has a cost of living index of 1499 so its significantly more expensive than both Arizona and the national average. Californias is 675 cents a gallon. This is a one-time fee and there are separate additional fees based on the vehicles weight.

Why are gas prices higher in California. In fact California ranks amongst the top three on the list of most expensive states in the USA while Arizona. It is significantly cheaper to live in Arizona than in California.

Tax Rates in both these states differ greatly. Are taxes cheaper in Arizona than California. Florida follows with a new vehicle registration fee of 225.

Texas residents also dont pay income tax but spend 18 of their income on real estate taxes one of the highest rates in the country. Answer 1 of 14. The state income tax sales tax and property taxes are lower than that of.

Tax Rates in both these states differ greatlyArizona individual income tax rate is 454 while Californians need to pay 93. The taxes in Arizona are cheaper compared to the other states. Lots of variables to consider.

The Average Cost of living in California is 277 more expensive than Arizona. Are taxes cheaper in Arizona. By Heleen March 4 2022 516 am.

In 2022 single taxpayers with incomes of up to 27272 in Arizona will see a 255 income tax rate while those earning more than that will have to pay. Income Tax Rates. Registration fees following the first fee.

Are taxes cheaper in Arizona than California. This clearly implies that the state income tax of Arizona is lesser than that of California. The question implies concerns about cost of living not relative affordability.

While the range for the state income tax in California has 10 income brackets. Residents of the coastal state have to pay almost twice more of the state income tax. Residents of the coastal state have to pay almost twice more of the state income tax.

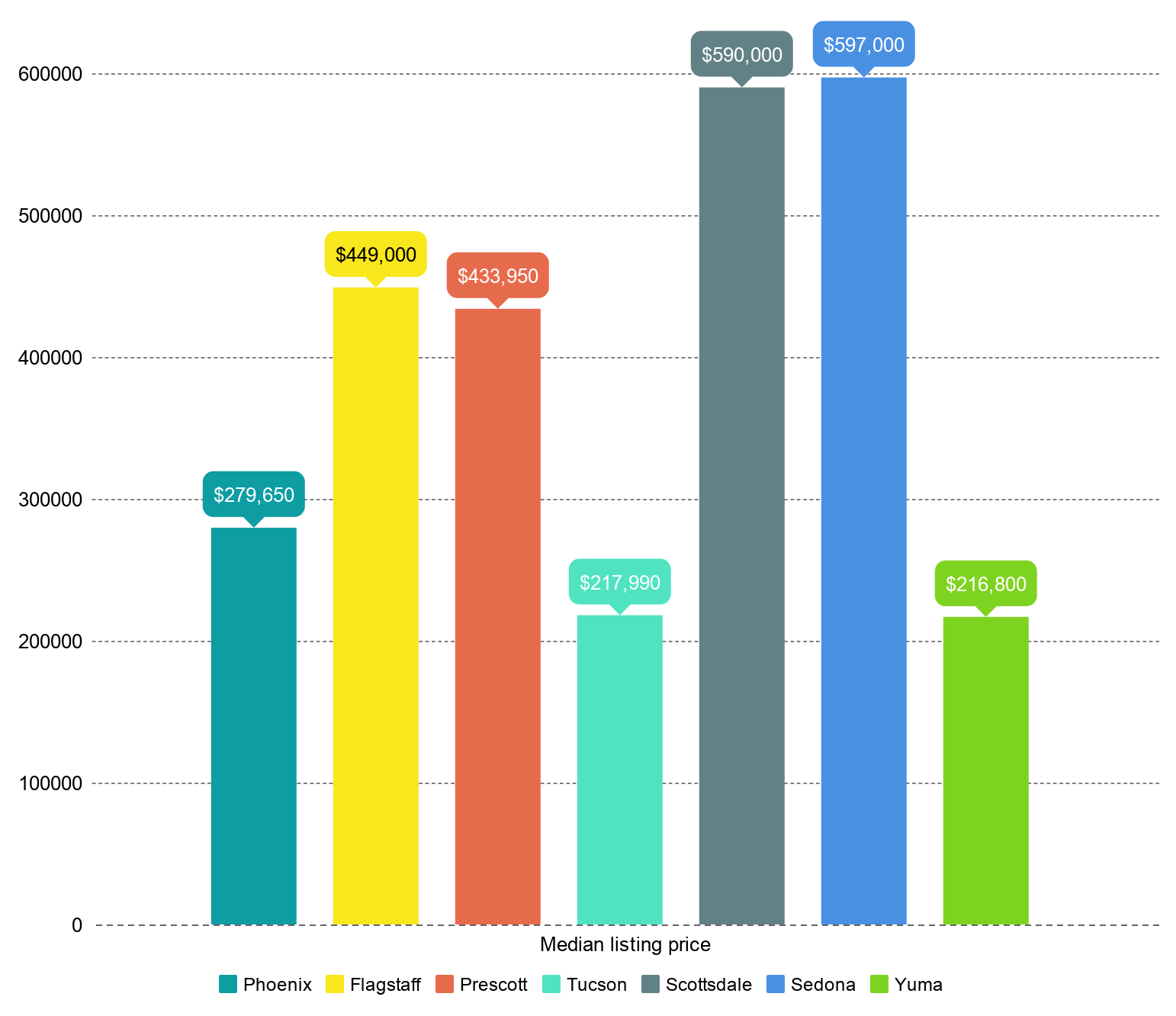

Arizona and California both are neighboring countries. The median price of a home in Arizona. Compare these to California where.

Tax Rates in both these states differ greatly.

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Arizona Is A Low Tax State Overall But Not For Families Living In Poverty Itep

Arizona Sales Tax Relatively High Many Valley Rates Mostly Stable

States With The Highest Lowest Tax Rates

Why Some Cities In Low Tax States Have The Highest Property Tax Rates

Experts Arizona Shielded From California Style Spike In Gasoline Prices Cronkite News

Supreme Court Refuses To Hear Arizona Challenge To California Tax Law Cronkite News Arizona Pbs

Comparing Arizona Vs California Cost Of Living In 2022

State Income Taxes Highest Lowest Where They Aren T Collected

States With The Highest Lowest Tax Rates

Nevada Vs California Taxes Explained Retirebetternow Com

Passing On Gas Biden S Gas Tax Holiday Gets Cool Reception In Arizona Cronkite News Arizona Pbs

Moving From California To Arizona California Movers San Francisco Bay Area Moving Company

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

How Do State And Local Property Taxes Work Tax Policy Center

Arizona S 30 Largest Cities And Towns Ranked For Local Taxes Kiplinger

Moving From California To Arizona California Movers San Francisco Bay Area Moving Company

The 10 Most Tax Friendly States For Middle Class Families Kiplinger

Wait California Has Lower Middle Class Taxes Than Texas Bloomberg